Volatility on BTC – Bitcoin’s fall below $70,000 led to the liquidation of $277 million. Long positions suffered the biggest losses, with $224 million liquidated over the past 24 hours.

Support on the chain around $68,000 seems to have allowed the price to rise. BTC actually took the opportunity to return above $70,000. But will it be possible to absorb the sales pressure from the miners in the long term? A few days before the halving, the behavior of minors is different compared to 2020-2021. That’s today’s newsletter!

Bitcoin price returns to $70,000

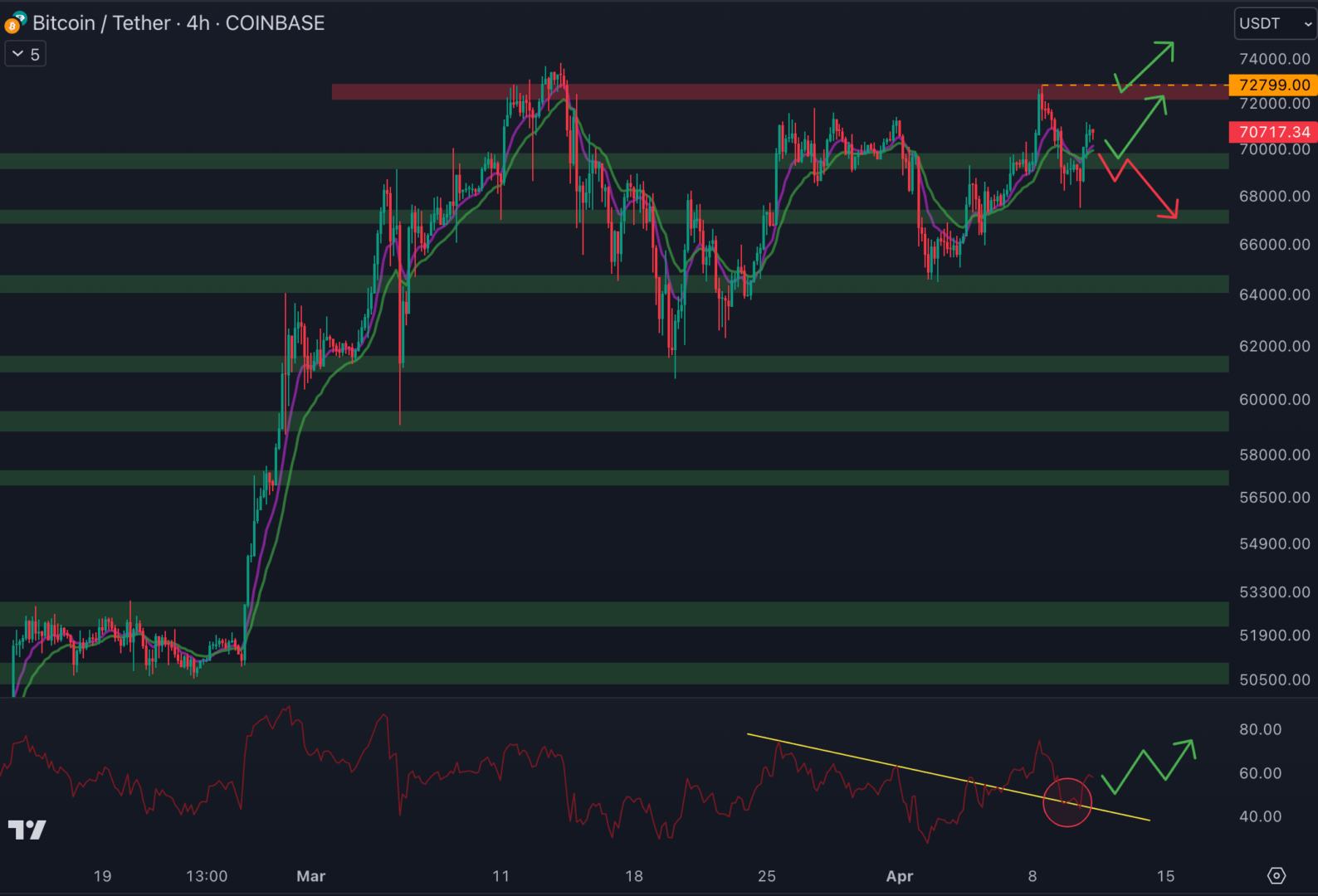

Thanks beautiful buying reaction below $68,000bitcoin price returns above 70,000 dollars. BTC continues lateralize a few days before halvingbut rises more than 2% in 24 hours :

Within one week, the course shows a an increase of more than 8%. Also BTC is higher than 50% in three months. As for the BTC/ETH pair, it is rising by more than 10% in one month and 15% in six months.

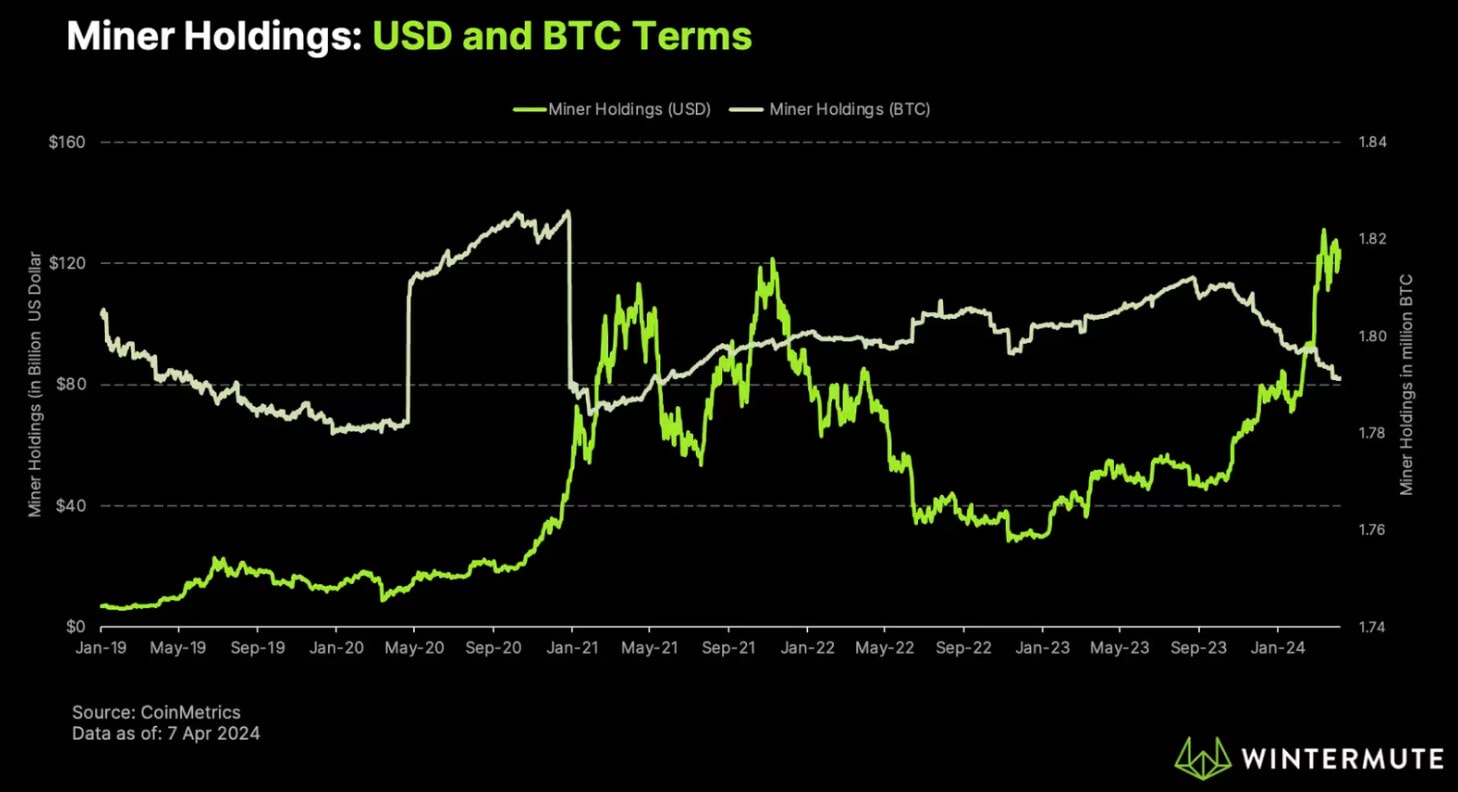

Miners sell their BTC before the halving

Historically, the king of cryptocurrencies has exploded upwards after splitting in half. However, several events can break the cycle. Bitcoin already does recorded a new historical high thanks to speculation around spot ETFs. Then it seems that the minors have a different strategy than they did in 2020-2021 :

In 2020, just before Bitcoin’s strong rise, BTC miners piled up. However, we currently observe a distribution behavior. The number of bitcoins held by miners is lowest since May 2021. The recent rally of the cryptocurrency king has allowed miners to be able to make substantial profitsand thus be able prepare for halving – to reduce rewards – in upgrade their hardware. Can spot ETFs absorb miners’ selling pressure?

Back to $72,500 for Bitcoin?

Despite a slight deviation below support at $69,500the buyers managed to produce sellers to sell. If support at $69,500 holds, BTC could continue its momentum with rising 4H lows and highs:

PUSH next resistance lies at $72,500. It will be necessary to fence last high at $72,800 continue bullish momentum. On the other hand, in the case loss of support of $69,500return to 67,000 dollars is possible. The RSI is currently a bounce at the bearish trendline levelbut it will be necessary to continue to form ascending troughs and peaks on the other side of the trend line.

BTC miners seem to be taking advantage of the extraordinary rally in recent months to take profits. A situation that differs from the last run with the bull. The selling pressure will have to be absorbed by the operators to avoid a deeper phase of the fall of cryptocurrencies. While Bitcoin is lateralizing below its most recent ATH, the exchange token sector appears poised to start growing again.

BITCOIN NEWS THAT COUNTS

- Bitcoin’s fall below the psychological $70,000 round number punished buyers who believed Bitcoin was headed for a new all-time high. In total, the market saw $277 million in liquidations.