Bitcoin price surprisingly avoided a sell-off on Wednesday following the release of the United States Inflation (CPI) for the month of March. How does BTC withstand rising market interest rates and the risk of a second wave of inflation?

The market no longer believes in this year’s FED 3rd rate cut

US consumer inflation for the month of March and CPI was eagerly awaited on Wednesday, coming in above expectations in both its core (the most important) and nominal versions. This CPI gauge, which has been overheated since the beginning of the year, is apparently being debated because it provides a representation of inflation that appears to be at odds with inflation observed in real time from much more direct sources.

For example, property rent inflation, which is still at 5.7% in CPI, while real estate websites and real estate indices, which provide the price of rents observed in real time, say that the rate of rent inflation is already below 2%. Real estate accounts for 40% of the CPI calculation, so this gap between the CPI and the real-time observed data is not a trivial fact and is explained by the delay (several months) before the data at time t comes back to the ICC.

👉 How to easily buy bitcoins? follow the leader

There is also this inflation of services reflected in the CPI (due to the spike in the price of auto insurance), while direct sources (such as the Truflation app) of real-time prices of a wide range of services describe the continued disinflation of service prices.

On the other hand, keep in mind that the Federal Reserve (FED) uses the PCE price index (and not the CPI) to track inflation, and that core PCE continues its downward trend as of the latest update.

In short, these multiple deviations, which can also be linked to the update of the CPI calculation methodology.

Finallyhigh finance is losing hope of seeing the Fed cut rates three times this year. According to the latest market expectations, only 2 rate cuts (at best) by the Fed are expected in 2024.

A graph designed by Bloomberg that reveals high finance expectations for the development of the Fed funds rate by the end of the year

Buy cryptocurrencies on eToro

👉 You can also find Vincent Gann in a video on the Cryptoast Research YouTube channel:

Bitcoin shows amazing resistance to the fundamentals of traditional finance

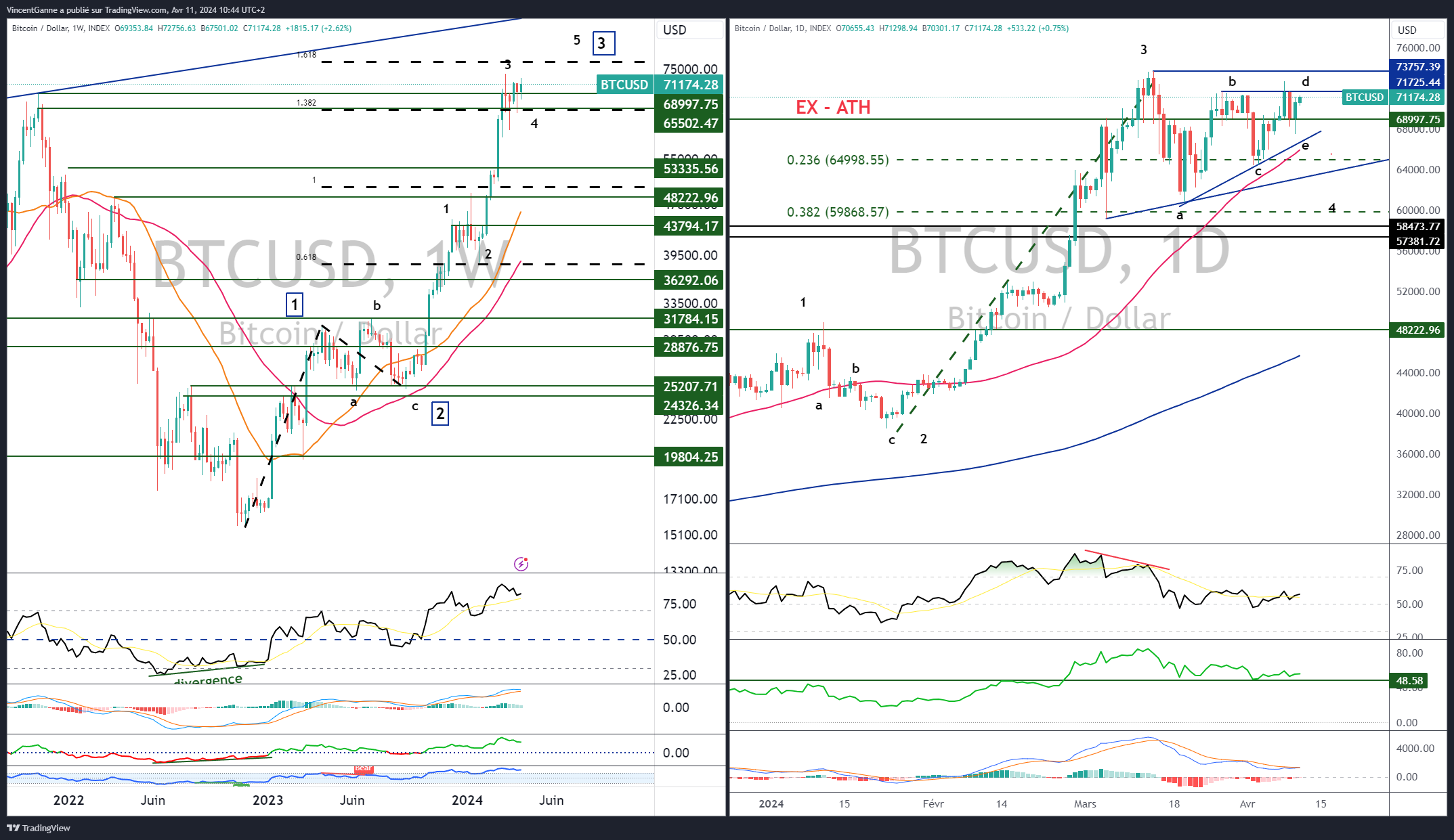

In terms of technical analysis, Bitcoin price technical analysis remains unchanged, with the market in a sideways transition phase since March 15. This pause period consolidates the vertical uptrend from late January to mid-March and can take several forms and have several amplitudes before allowing the underlying uptrend to continue.

Come find me every morning at Cryptoast Research for my Bitcoin trading strategy for the session.

📈 If you want Vincent Ganne’s opinion on Bitcoin trading every morning, as well as his best setups on altcoins, then join the Cryptoast Research professional service! Satisfied or money back for 15 days, so don’t hesitate anymore!

Chart created with TradingView revealing weekly and daily Japanese candles for BTC/USD

Chart created with TradingView revealing weekly and daily Japanese candles for BTC/USD

To deepen your technical analysis, find me on the Cryptoast Research YouTube channel!

Find Technical Analysis by Vincent Ganne Research cryptoasts, the perfect place to successfully invest in cryptocurrencies. You will learn how to position yourself at strategic price levels, find investment opportunities and predict price movements. Join us and take care of your crypto investments.

Cryptocurrency Research: Don’t Miss This Bull Run, Surround Yourself With Experts

Newsletter 🍞

Receive a summary of crypto news every Monday by email 👌

What you need to know about affiliate links. This site may contain investment-related assets, products or services. Some links in this article may be affiliate. This means that if you purchase a product or register on a site from this article, our partner will pay us a commission. This allows us to continue to offer you original and useful content. Nothing will happen to you and you can even get a bonus using our links.

Investing in cryptocurrencies is risky. Cryptoast is not responsible for the quality of the products or services presented on this site and cannot be held responsible, directly or indirectly, for any damages or losses incurred after using the goods or services highlighted in this article. Investments related to cryptoassets are inherently risky, readers should do their own research before taking any action and invest only within their financial means. This article does not constitute investment advice.

recommendations of the AMF. There is no guaranteed high return, a product with high return potential involves high risk. This risk taking must be in line with your project, your investment horizon and your ability to lose some of these savings. Do not invest unless you are prepared to lose all or part of your capital.

To go further, read our Financial Situation, Media Transparency and Legal Notice pages.