This first day of May, crypto naturally speculates on the question that comes up every year: should investors follow the saying “sell in May and walk away”?

Historical data presents a mixed record, with the price of Bitcoin showing an average return of 7.66% during the months of May, but a median return of -3.17%. This disparity thus raises the question of whether this spring month is really the time to take a step back from the market or take advantage of the crypto opportunity.

Sell your crypto in May and go do other things?

Crypto SunMoon, a famous Korean analyst, offers a bullish outlook for the month of May. According to SunMoon, if Bitcoin remains in a bull market, then the Price Realized Short Holder (STH) indicator price at $59,000 represents a critical support line.

This indicator actually represents the average purchase price of short-term market participants over the past six months. Thus, this zone indicates a potentially lucrative buying opportunity if tested and BTC continues its uptrend.

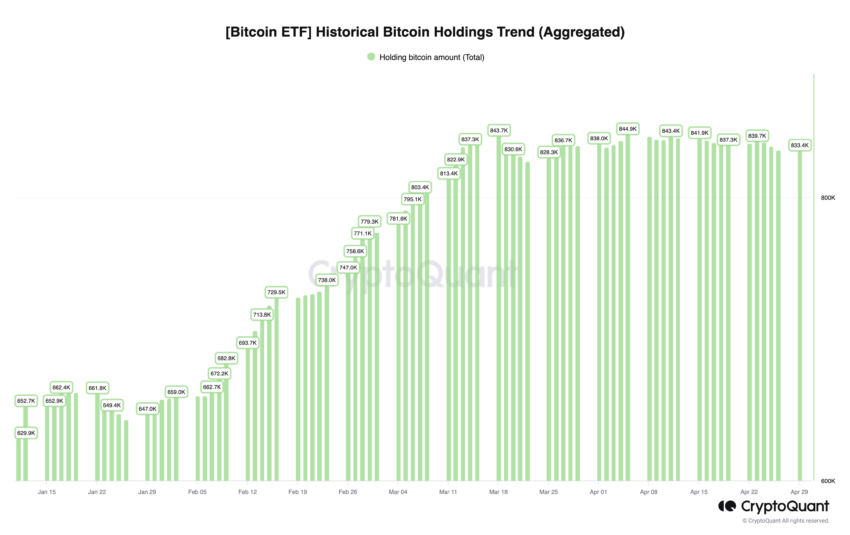

Adding to the bullish sentiment, Lark Davis highlights an imminent supply shock that could reshape the crypto market. With Bitcoin halving, mining reduced to just 450 BTC per day, and the introduction of spot BTC ETFs in markets such as the US, Hong Kong and Australia, demand is exploding as the supply of crypto assets tightens.

“Institutions around the world are lining up to own a piece of the Bitcoin pie. BTC supply on all exchanges is at an all-time low. The displays on the counters are dry. This bull run is going to be a lot crazier than you think,” Davis noted.

Bill Barhydt, CEO of Abra, shares this optimism. Barhydt predicts massive growth in the global market capitalization of cryptocurrencies, which could reach $50 trillion in the next decade.

This growth is expected to revolutionize credit markets, especially in emerging economies.

“I think we are still at the very beginning of discovering the global crypto investment community like Bitcoin, Solana and Ethereum. This will increase the crypto market capitalization from $2.5 trillion today to $50 trillion within the next 10 years, or even sooner,” Barhydt said.

Read more: Bitcoin Prediction 2024/2025/2030

Given these elements, the idea of ”selling and leaving” in May no longer seems so obvious. Therefore, crypto investors should compare historical trends with current market conditions as well as future forecasts. With expert opinions pointing to continued bullish sentiment and significant market developments on the horizon, the month of May could end up being more favorable for strategic purchases than sales of its cryptocurrencies.

Moral of the story: The cryptocurrency adage is only as good as you believe it to be.