Analysts and market watchers are therefore particularly keen to understand how these major crypto players are positioning themselves before an important milestone that has had an impact on the price of Bitcoin and market dynamics in the past.

Despite bearish conditions, whales are buying

Recent data from blockchain analytics platforms such as CryptoQuant and Santiment reveal a significant shift in crypto whale activity. According to a tweet from CryptoQuant, there is indeed an increasing accumulation of BTC by whales, indicating a bullish outlook from those expecting a supply cap after the halving.

The influx of bitcoins to storage addresses thus reached a new historical high on April 18.

“Bitcoin inflows to accumulative addresses hit a new all-time high of 27.7,000 BTC yesterday,” noted CryptoQuant.

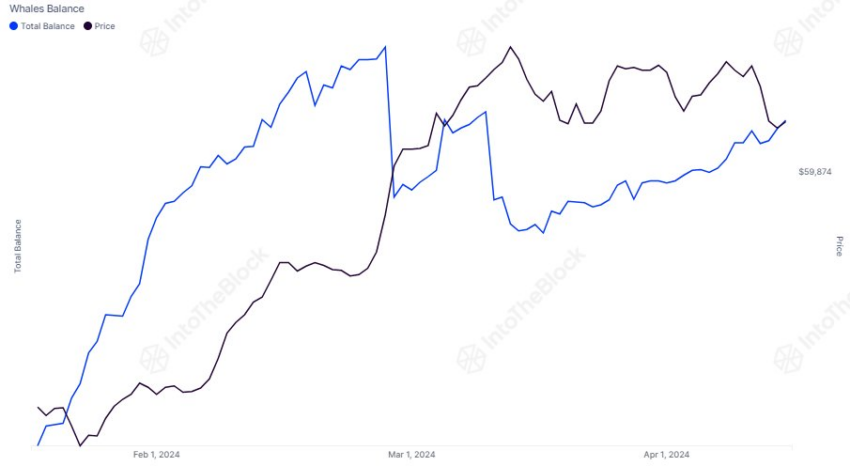

IntoTheBlock also provides additional information showing that large holders (1,000 BTC or more) have increased their holdings by 16,300 BTC in the past seven days, equivalent to $1 billion at current crypto asset prices. However, the biggest whales haven’t started buying yet.

“The biggest whales holding at least 0.1% of the supply have not started to rally and even went down a bit yesterday,” notes IntoTheBlock.

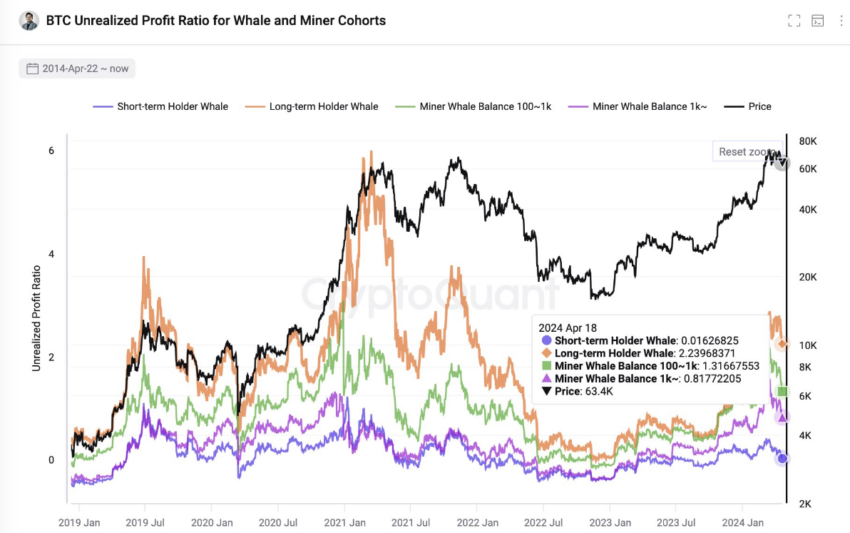

Ki Young Ju, CEO of CryptoQuant, said on Twitter that the historical pattern of increasing holding times around the half indicates strong sentiment among holders. This behavior is consistent with the general expectation that reduced supply due to halving and sustained or increased demand will lead to higher prices. Ju notes that unrealized benefits for on-chain cohorts, specifically miners and whales, remain positive.

“Not enough profits to end this cycle, imo.” concludes Ju.

Go further: How to buy bitcoins? Everything you need to know

Bears could face resistance

Santiment’s analysis also shows that the general consensus remains bearish despite Bitcoin hitting $63,800 on April 18. However, Santiment notes that this could still be seen as a sign of a potential recovery.

“The crowd has maintained consistent bearish sentiment toward higher caps, strengthening the case for further growth.” said Mr. Santiment.

Observers view bitcoin halving, which cuts the reward for mining new blocks in half, as a deflationary mechanism that reduces the new supply of available BTC.

During previous halvings, this event led to a significant increase in the price of the asset in the following months. Investors and analysts therefore believe that this year’s event could follow a similar pattern, although the extent of its impact remains to be seen.

So, as the halving approaches, seasoned traders and more casual market watchers alike are keeping a close eye on the activities of the Bitcoin whales. Indeed, their movements offer valuable clues about potential market directions and sentiments, setting the tone for small investors looking to navigate the changing crypto landscape.

Moral of the story: Whales, victims of crypto paparazzi.

Disclaimer

Disclaimer: In accordance with The Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to providing accurate and unbiased information, but market conditions may change without notice. Always do your own research and consult with an expert before making any financial decision.